Metrics and economic factors can help shippers gauge capacity and freight rates for air, ocean, trucking and rail heading into freight’s busy season.

The holiday season for consumers is still a few months away, but peak season for freight is getting started as supply chains prepare for the shopping months of November and December.

The pandemic continues to hammer the economy and weaken consumer demand, meaning this year could look different from peaks past. Here is a look at capacity and rates for airfreight, ocean shipping, rail and trucking heading into freight’s busy season.

Air

Air cargo has been one of the most volatile shipping modes in 2020 as airlines canceled passenger flights, resulting in a significant decrease in belly capacity, and governments and private sector organizations rushed personal protective equipment shipments to the fastest freight lane.

As a result, prices have fluctuated wildly. A survey by Resilience360 and Business Continuity Institute found 37% of shippers had seen their air transport disrupted by the pandemic — the highest rate among the freight modes. The decreased capacity and high rates made it increasingly difficult to find space through the pandemic.

“The airlines have torn up the rule book … in terms of how the market usually contracts,” said Peter Stallion, head of airfreight at Freight Investor Services. “So you have a situation where shippers are, by and large, somewhat more exposed to market volatility than they were before.”

2020 air freight rates from China to US

It has become common to have a monthly rate agreement between a carrier and forwarder, and then between a forwarder and shipper. There are other situations where a forwarder and a cargo owner might agree on a short-term fixed rate “at a relatively high price” just to secure capacity, Stallion said.

“It means that any sort of changes in the underlying market have pretty serious ramifications for the prices that are realized by shippers and forwarders and airlines in Q4,” Stallion said.

Stallion named a few metrics to keep an eye on to gauge how the market will play out in Q4:

- Passenger airline traffic: This can help gauge belly capacity in the market.

- Inventories: Garment companies have traditionally been large airfreight users, but right now their inventories are full and they’re waiting for those to deplete before importing again.

- Technology releases in Q4: If a tech company, like Apple, releases a new product in the fourth quarter, it will decrease capacity on routes out of Asia.

“It’s very straightforward stuff and not much is actually forecastable,” Stallion said. “There’s just a few things that everyone is watching or needs to watch and can take action based on some pretty key changes.”

Ocean

Ocean shipping has been another volatile area this year as ocean carriers blanked record amounts of capacity in an attempt to match cratering demand for their services. The Resilience360 and Business Continuity Institute survey found almost 15% of shippers had seen their ocean transport significantly affected by the pandemic.

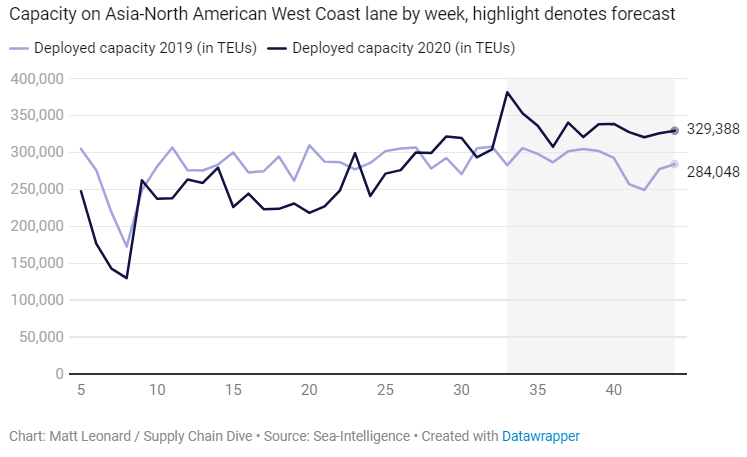

But the latest data shows carriers are increasing capacity on Transpacific routes heading into peak season — and not just compared to earlier this year, but compared to 2019.

Capacity expected to grow for peak season

“On Asia-North America West Coast, carriers have un-blanked 30 previously announced blank sailings for Q3,” Sea-Intelligence CEO Alan Murphy said in a statement at the end of July. “From week 29 onwards, virtually no blank sailings are scheduled on the trade lane … with the Y/Y capacity growth suggesting that, from the carriers’ deployment considerations, Coronavirus is no longer as big a challenge.”

August is typically the peak month for ocean shipping, though in recent years this has split into two peaks with one forming in the summer for back to school and the other in the fall ahead of the holidays, according to Daniel Hackett, a partner at Hackett Associates. Peak was slightly abnormal in 2019 as well as shippers sought to pull forward inventory ahead of tariffs.

“In terms of a peak month this year, we’re not really projecting peak months of the type that we used to see,” Hackett said.

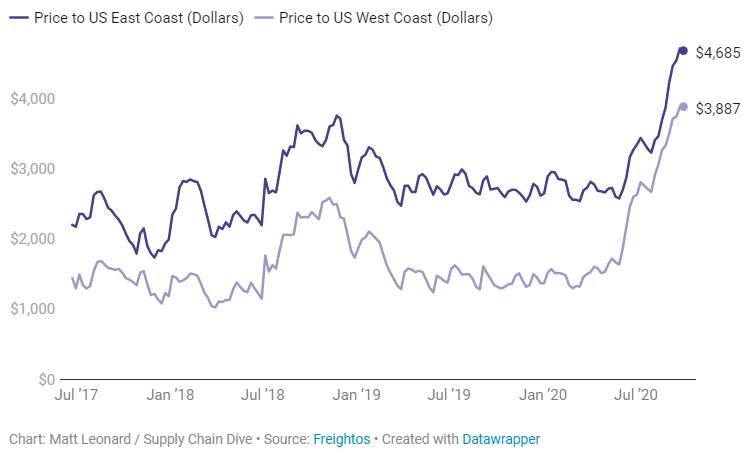

Spot rates from China/East Asia to US

In June, importers began bringing in more inventory as talks of reopening economies began circulating. This wave of imports hit a freight market with a lot of pulled capacity, and rates skyrocketed.

This could be an issue for peak season as well if volume outpaces the container line capacity, Hackett said. Though the latest numbers from Sea-Intelligence suggest there should be capacity to go around.

And with capacity coming back to the market, ocean freight rates are beginning to cool off. The addition of sailings back to Transpacific routes “tilted the thin balance” in favor of shippers, according to Bimco. Freight rates from Asia to the U.S. West Coast dropped $405 per FEU on Aug. 15.

“Just a little too much capacity [was] reintroduced, [bringing] spot freight rates sharply down,” said Bimco Chief Shipping Analyst Peter Sand.

Trucking

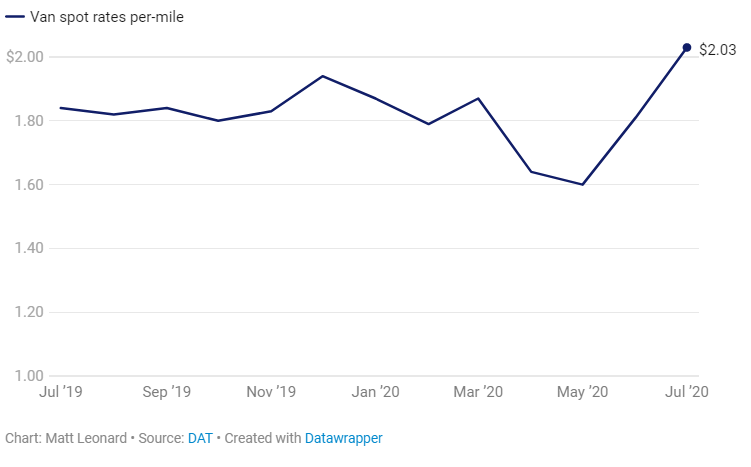

Spot rates in the trucking market hit their lowest point in April, down around 25% year over year. Since then, “we’ve seen quite a dramatic turnaround in rates,” said Avery Vise, VP of trucking research at FTR, adding that rates are rising at a time when they usually trend downward. Trucking rates will typically fall throughout the summer until the holidays.

Spot rates were up 10% year over year in July and have continued to trend upward, according to DAT. “I think it is likely to moderate,” Vise said. “But it quite possibly will still hold much higher than certainly we thought it would just a couple of months ago.”

FTR’s most recent forecast shows rates in the remainder of the year will moderate to levels lower compared to 2019, but a rosier picture could form with new industrial production numbers from the Federal Reserve. FTR’s next forecast won’t be out for two weeks but will likely “reflect expectations for a stronger rate environment for the rest of the year,” Vise said.

Payroll employment for the trucking market is down about 6% since February, which is a “dramatic shift” in trucking capacity, Vise said. The July jobs report did not show much capacity being added, which suggests rates will continue to be strong in the carrier’s favor, he said.

Spot rates surge

Some of the strength in the current rebound could be the result of supply chains catching up to pent up demand from May and June, which makes it harder to forecast, Vise said.

Going forward, trucking companies will likely start to bring back furloughed drivers, though this could be difficult if they found work elsewhere. Since mid-July, more carriers have been querying the Federal Motor Carrier Safety Administration drug clearinghouse, which is an early indication of hiring, Vise said.

The trucking market is also highly affected by its relationship with the other freight modes, specifically intermodal rail. Some shippers have the ability to choose between truck and intermodal based on the market conditions. Diesel prices have been low, which has helped to keep trucking competitive with intermodal, but that’s starting to change, Vise said.

Intermodal volumes have begun to grow as trucking rates have risen on tight capacity due to low employment numbers, he said.

Vise listed two key factors to watch for the health of the trucking market:

- Federal financial assistance. A lot of demand for freight movement was buoyed by federal funds in the CARES Act, and it’s not clear what demand will look like now that additional assistance has ended. The savings rate in the U.S. went up in the second quarter, so many still have cash on hand, but this could dry up as federal benefits end.

- How quickly trucking brings back capacity. Employment numbers and truck orders will provide some guidance here.

Rail

In rail, there are two different measures to look at: carloads and intermodal. Carload is mostly tied to the industrial economy and has been relatively flat throughout the pandemic.

“And we don’t expect that to change over the balance of 2020,” said Todd Tranausky, VP of rail and intermodal at FTR. “So we don’t expect to see a huge influx of carload volume over the last four months of 2020.”

Carload rates will likely go up, but less than previously expected (3% to 4%) as railroads have cut costs through the pandemic. “We still expect rate increases,” Tranausky said. “But we expect them to be more on the 1% to 2% range this year.”

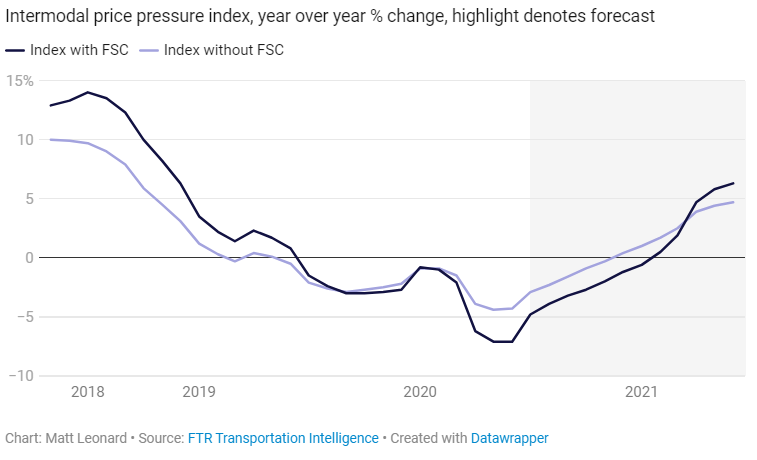

Intermodal rates expected to see growth in 2021

Intermodal forecasts are less clear. Volume was down year over year in July, but has begun to grow compared to 2019 in the first two weeks of August, according to the Association of American Railroads. The increase, Tranausky said, has been driven largely by two domestic factors:

- Regional tightness in the trucking spot market.

- Increase in parcel businesses driven by e-commerce.

This is also in line with comments on an earnings call last month by Norfolk Southern CMO Alan Shaw.

“As the economy reopened, intermodal volume improved as demand for our services grew and truck rates increased,” Shaw said. “Domestic volumes rebounded as the quarter progressed due to the need to quickly rebuild inventory, while international remained pressured. The increased use of e-commerce and essential goods led to more transloads and domestic equipment.”

Import and international volume, meanwhile, have been relatively weak this year. And even if imports do increase, it’s unclear if they’ll move out of warehouses because the consumer demand outlook is still foggy.

“We do expect [intermodal] rates to not grow this year,” Tranausky said.

Intermodal competes with trucking for some freight, and anecdotal evidence shows high trucking rates are leading shippers to use this in negotiations with railroads, but this hasn’t shown up in the volume.

One potential issue for railroads heading into peak season is the aggressive furloughing of employees the companies have engaged in this year. If volume returns to a reduced headcount, it could result in more missed switches in the first and last mile of a rail journey, Tranausky said. To monitor this, shippers can check their cycle time and look at the velocity and dwell on the lanes they use.

“So if I was a shipper, I would be preparing for what to do compensate for poor first-mile, last-mile service in my railroad,” he said.

CSX CEO Jim Foote said there is a lot of uncertainty around peak season as companies aren’t sure what to expect in terms of consumer demand. “I think you may see that e-commerce type of peak a little bit sooner as people stay home and sort of order stuff on the web,” Foote said. The railroad is in “a wait and see period,” he said.

“We’re not going to get the traditional peak season,” Tranausky said.

Reference: SUPPLYCHAINDIVE